Inheritance Tax Threshold 2025 Irs. The good news for beneficiaries in 2025 is that the tax implications are generally favorable. For people who pass away in 2025, the exemption.

There’s no limit on the number of individual gifts that can be. Estate tax the estate tax is a tax on your right to transfer property at your.

Inheritance tax threshold frozen until 2026 but why is IHT planning, The taxation of an inheritance depends on the state in which the deceased lived or owned property, the value of the.

UK Inheritance Tax Scope and Context, If you earn over the tax filing threshold, it is important to file.

Inheritance Tax in UK, In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

What is the threshold for federal estate tax? Leia aqui How much can, Gift or inheritance over $100,000 in the aggregate in the tax year (although proposed regulations have suggested that the irs may.

:max_bytes(150000):strip_icc()/inheritancetax.asp-final-96944c15e1cc4e17b4b94d7b88eb8cec.jpg)

What Are the Inheritance Tax Thresholds in the UK? Culver Law, The irs typically adjusts this gift tax exclusion each year based on inflation.

January 2025 Inheritance Tax Changes All You Need To Know Key, Federal tax rates range between 18% and 40%, depending on the amount above the $12.92 million threshold, or exemption amount, per person in 2025 or $13.61 million in.

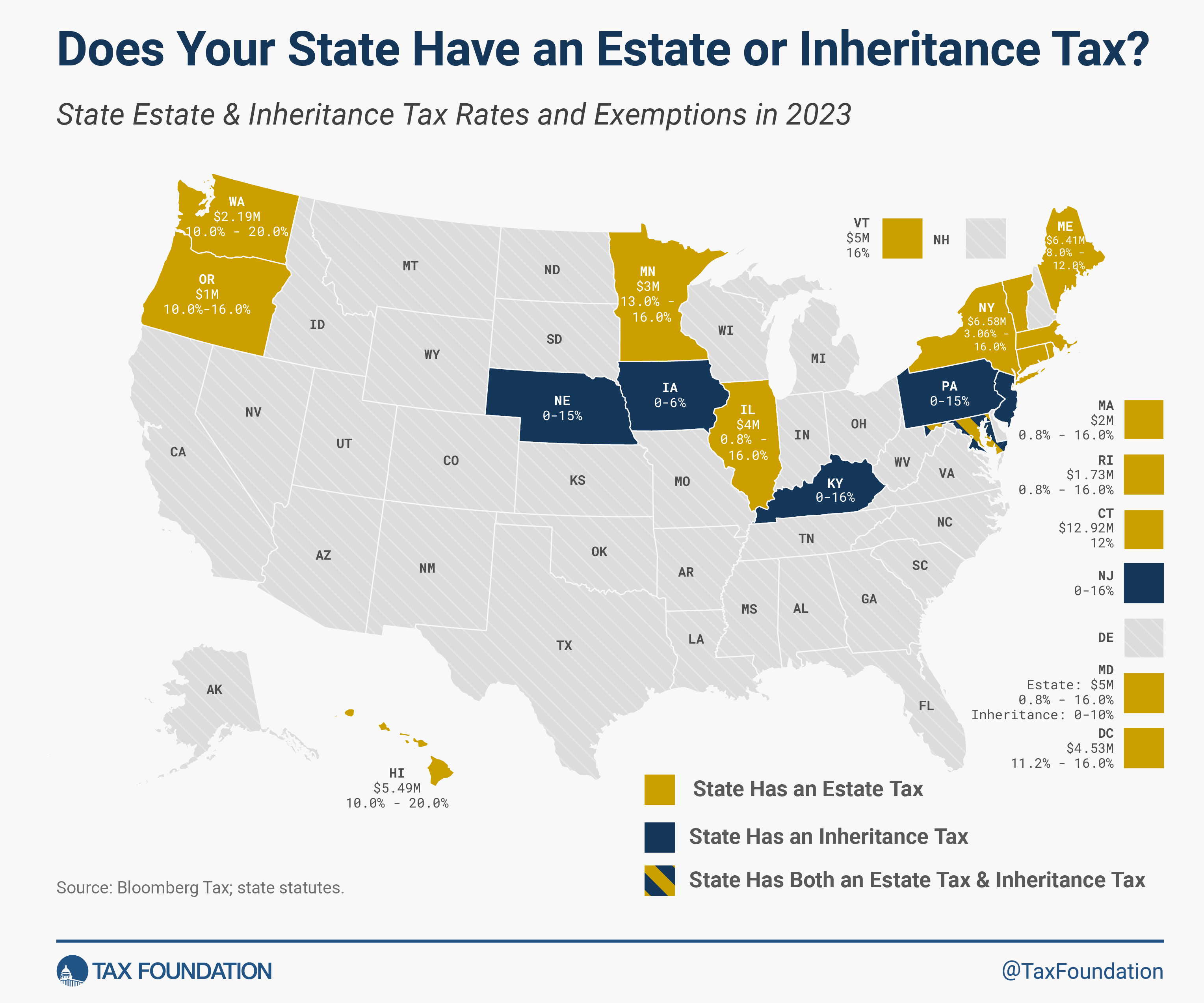

2025 State Estate Taxes And State Inheritance Taxes American Legal, Receiving an inheritance often prompts questions about tax liabilities.

Inheritance tax can be 'significantly reduced' through gifts, The 2025 election and tax policy.

Inheritance tax threshold frozen until 2028 Time to plan ahead? St, Income threshold for us expats.

What are the rules around the £1 million Inheritance Tax threshold?, As of 2025, six states impose an inheritance tax: